XFT Trading

Flows for trading tokenized alternative assets with XFT.

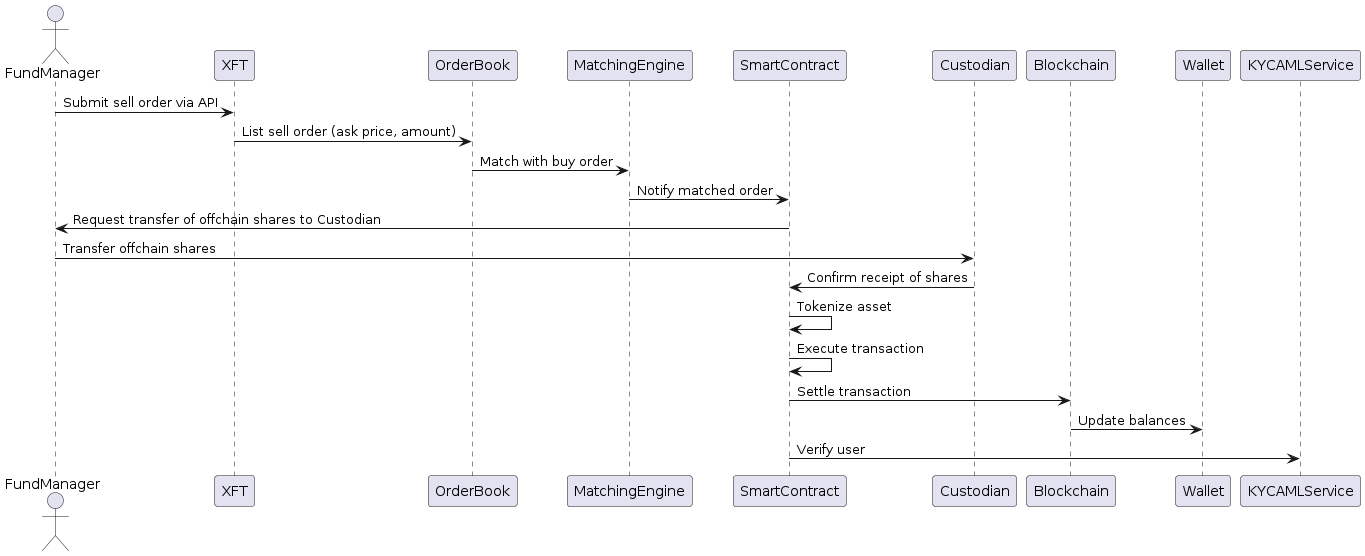

Offchain sell with execution

- Fund manager submits sell order via API.

- Order listed in order book.

- Matching engine finds buy order.

- Smart contract notified of match.

- Smart contract requests fund manager to transfer shares to custodian.

- Fund manager transfers shares to custodian.

- Custodian confirms receipt to smart contract.

- Smart contract issues tokens.

- Tokens to buyer, payment to seller.

- Record transaction on blockchain.

- Update wallet balances.

- KYC/AML protocols verify users.

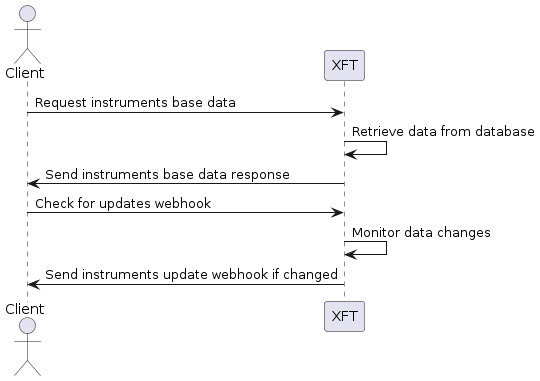

Get instruments base data

- Client requests instruments base data from XFT.

- XFT retrieves data from database.

- XFT sends instruments base data response to Client.

- Client checks for updates via webhook to XFT.

- XFT monitors for data changes and sends update webhook to Client if changes occur.

User registration

- Create user profile

- Generate wallet

- Return user ID and wallet address

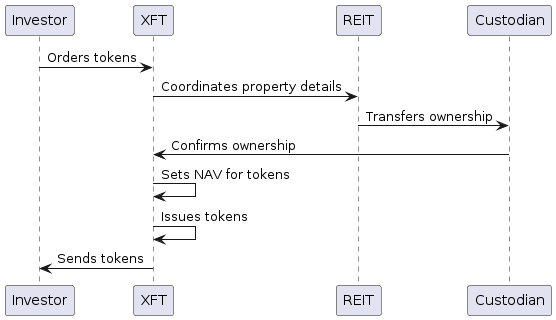

NAV-based order process and creation of REIT tokens

- Investor orders tokens with XFT.

- XFT coordinates property details with REIT.

- REIT transfers ownership to Custodian.

- Custodian confirms ownership.

- XFT sets NAV for tokens.

- XFT issues tokens.

- XFT sends tokens to investor.

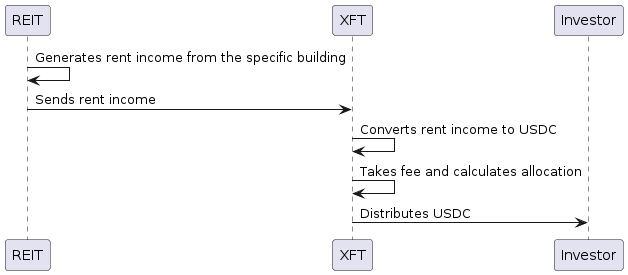

Rent distributions for REIT tokens

- REIT generates rent income from the specific building.

- Rent income is sent by REIT to XFT.

- XFT converts rent income to USDC.

- USDC is allocated proportionally to token holders.

- XFT distributes USDC to investors' wallets.